दुसरीकडे, आम्ही योग्य

संतापाने निंदा करतो आणि फसवलेल्या

लोकांचा तिरस्कार करतो

दुसरीकडे, आम्ही योग्य

संतापाने निंदा करतो आणि फसवलेल्या

लोकांचा तिरस्कार करतो

त्यांचं कर्तव्य इच्छाशक्तीच्या

कमकुवतपणामुळे, म्हणजेच श्रमांपासून

मागे हटणं असं म्हणणं आहे.

इच्छाशक्तीची कमकुवतता,

जी त्यांचं कर्तव्य असं म्हणण्यासारखीच आहे,

म्हणजे श्रमांपासून मागे हटणं.

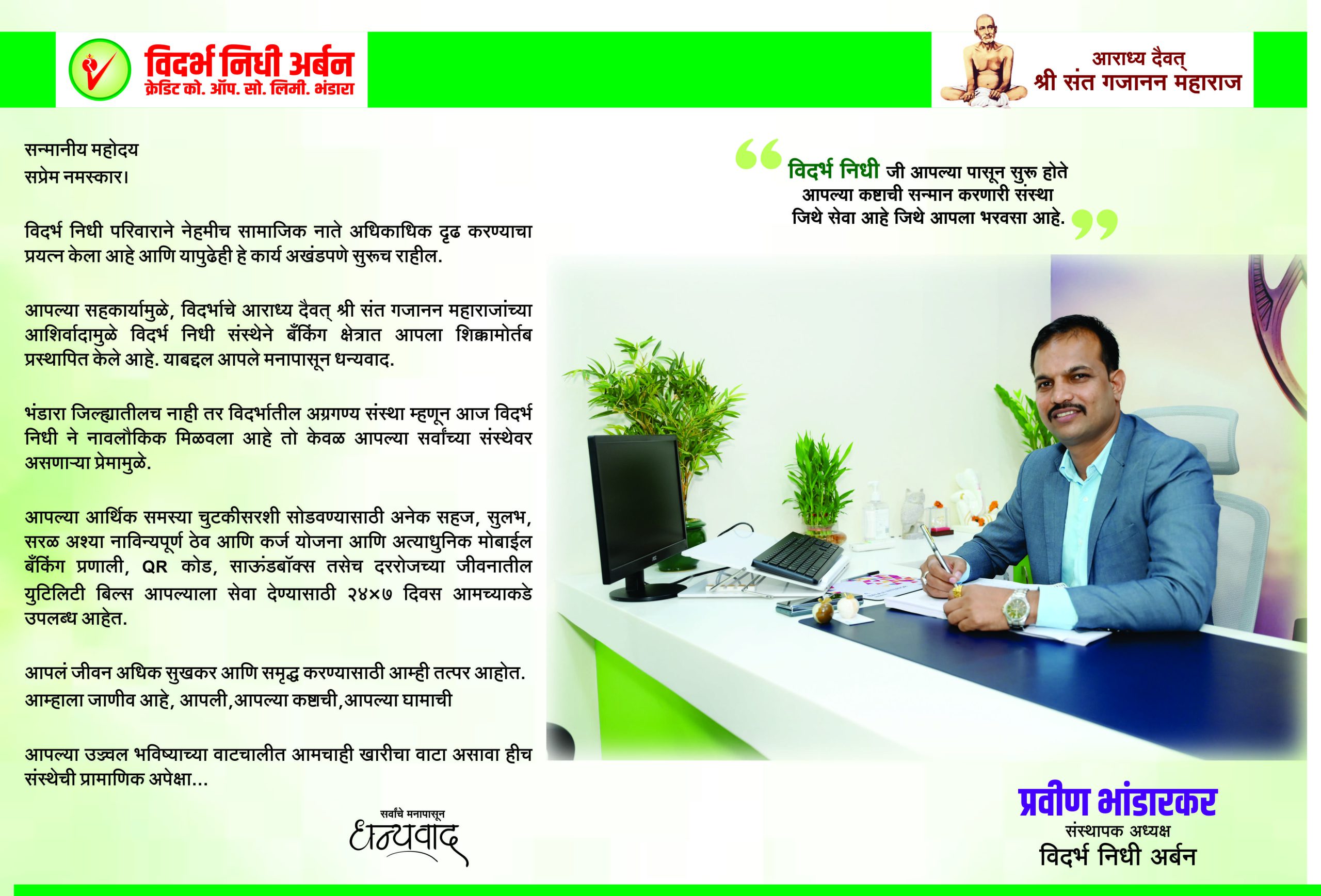

We are ready and committed to make you successful

A fixed deposit is an instrument where an investor deposits a lump sum with a financial institution for a fixed period of time.and vidarbha nidhi urban credit co-operative society or earns a fixed rate of interest on the deposited money which is higher than a regular savings account.

A Recurring Deposit Account is a type of deposit account where you can deposit a small fixed amount every month for a chosen term. The bank offers a fixed rate of interest on the deposit amount which is compounded on a quarterly basis. Vidarbha Nidhi Urban offers online RD accounts for more benefits to our valued members.

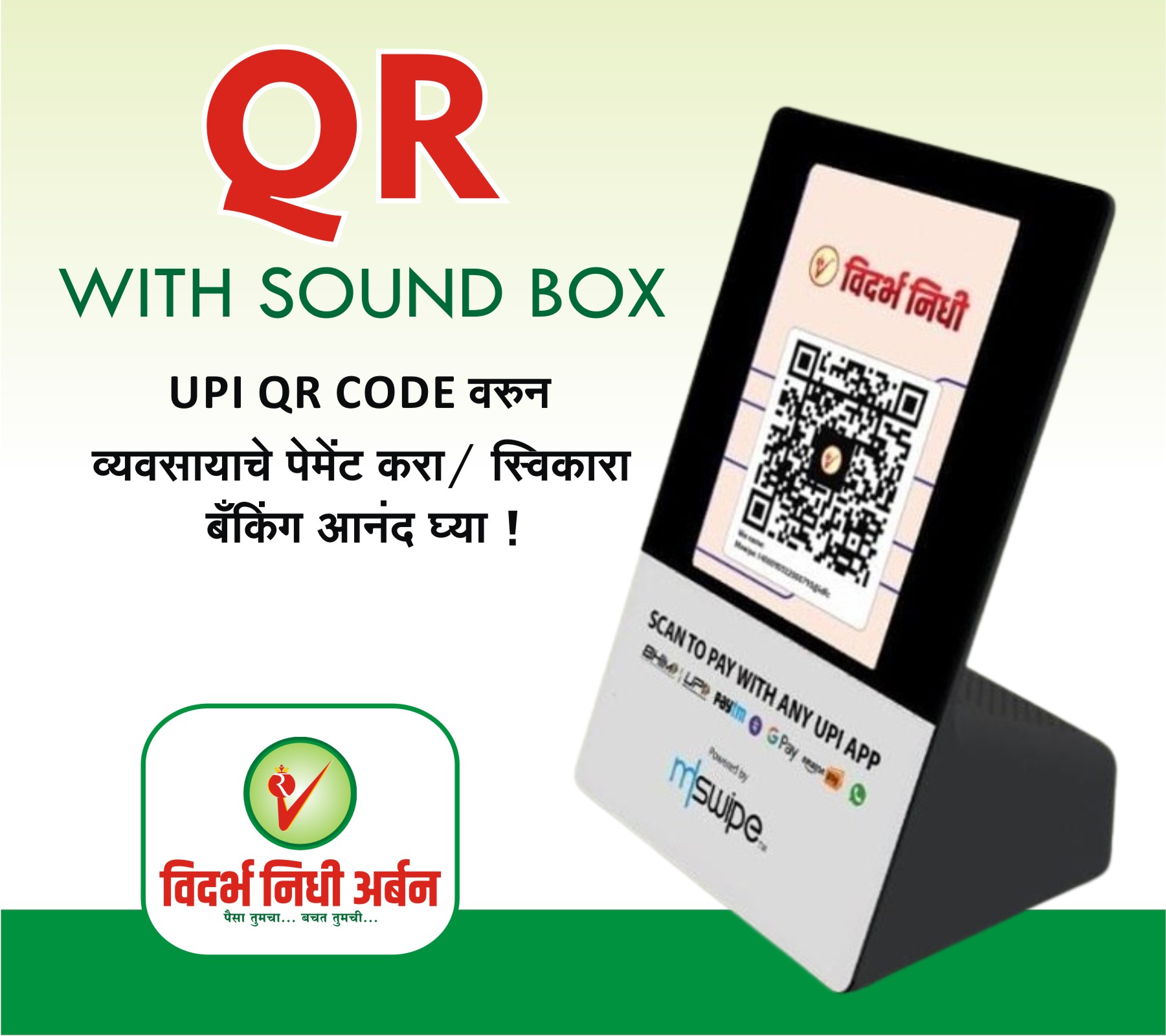

From daily earnings to savings, small savings is a safe and secure investment option. They also help people develop the habit of saving, which can help them achieve their financial goals. For more benefits we provide online QR savings.

Vidarbha Nidhi Urban gives you loan for purchase of two wheeler. Now don’t worry about money to buy your own bike, because we provide bike loan with low interest rate ...

Vidarbha Nidhi Urban offers loans based on your assets. Easily meet your financial needs by mortgaging your property, with low interest rates and fast approval loans.

Vidarbha Nidhi provides both Urban Salary Loans and Individual Personal Loans. Depending on your requirement, you will get a loan at a low interest rate with fast approval, which will ...

Vidarbha Nidhi Urban now offers you loans to buy gold. Get instant approval at low interest rates and make your dreams come true.

Vidarbha Nidhi Urban provides you loan to buy mobile. Get instant approval at low interest rates and get your right smartphone.

Vidarbha Nidhi Urban provides loan facility to refill your LPG cylinder. Get a loan for your needs with less paperwork and instant approval.

Vidarbha Nidhi provides loans for purchase of urban solar panels. With low interest rates and quick approvals, going solar now is easy and affordable.

All financial services in one list

Find answers to all your questions about our service.

You will not incur any charges for purchasing a new soundbox and monthly monthly charges will also be incurred if you draw a daily digital account. (For more information contact the branch)

Loan/deposit borrowers change every quarter. Visit your nearest branch.

yes Visit the nearest branch or visit the nearest CSC.

Vidarbha Nidhi is an institution and ICICI and NPCI of Reserve Bank of India are all attached to this institution. So there is no risk. Mobile banking is safe.

You can collect information by calling 9613101666, 9613102666 or visit the nearest branch.

Savings is a general account which offers less facilities than super and current accounts. Whereas super saving gets the same services as current but current gets other services except the saving services. For more information visit any branch of Vidarbha Nidhi Urban.

Now banking services in your hands! Secure financial transactions from anywhere anytime.

Now banking services are more modern, faster and more secure too.

Spend

Minimum 40 US Dollar

Not Valid for

Commercial Credit Card

Now send money to any account in seconds with VSNL urban's free IMPS service.

Spend

Minimum 75 US Dollar

Spend

Minimum 50 US Dollar

Claims off duty or the obligations business it will frequently occur that pleasures be repudiated.

Spend

Minimum 40 US Dollar

Not Valid for

Commercial Credit Card

Claims off duty or the obligations business it will frequently occur that pleasures be repudiated.

Spend

Minimum 40 US Dollar

Not Valid for

Commercial Credit Card

Claims off duty or the obligations business it will frequently occur that pleasures be repudiated.

Spend

Minimum 40 US Dollar

Not Valid for

Commercial Credit Card

Claims off duty or the obligations business it will frequently occur that pleasures be repudiated.

Spend

Minimum 40 US Dollar

Not Valid for

Commercial Credit Card

Easily calculate your equated monthly instalment online.

Home Loan

Personal Loan

Vehicle Loan

$720,260

$720,260

$720,260

$720,260

$720,260

$720,260

Download our app for the best experience

This will close in 0 seconds

VSNL Bank

Hello,how may i help you?

Any questions ?

WhatsApp Us

🟢 Online | Privacy policy

WhatsApp us